Real Estate Loan Programs

-

Do you Have Money for Closing cost ?

-

Do you have money for an property appraisal?

-

Do you have money for a down payment?

-

How is your credit score?

-

Do you have the property under contract?

We Prefer to do Loans at 500k or Higher please.

Hard Money Loan

is a specific type of asset-based loan financing through which a borrower receives funds secured by real property. Hard money loans are typically issued by private investors or companies. Interest rates are typically higher than conventional commercial or residential property loans because of the higher risk and shorter duration of the loan.

a. Most of the time for fix n flips. Most lenders will give 65% LTV, some 70% LTV , a few maybe 75% LTV, rarely give you 80% LTV ( loan to Value) b. 100% of the repair costs. c. Most charge 2 to 4 points upfront fee (2% to 4%). d. Time is usually anywhere from 3, 6, or 12 months.

Private Money Loan

a commonly used term in banking and finance. It refers to lending money to a company or individual by a private individual or organization. While banks are traditional sources of financing for real estate, and other purposes, private money is offered by individuals or organizations and may have non traditional qualifying guidelines. There are higher risks associated with private lending for both the lender and borrowers. There is traditionally less "red tape" and regulation.

Bridge Loan

A bridge loan is a type of short-term loan, typically taken out for a period of 2 weeks to 3 years pending the arrangement of larger or longer-term financing. A bridge loan is interim financing for an individual or business until permanent financing or the next stage of financing is obtained. Money from the new financing is generally used to "take out" (i.e. to pay back) the bridge loan, as well as other capitalization needs.

Bridge loans are typically more expensive than conventional financing, to compensate for the additional risk. Bridge loans typically have a higher interest rate, points (points are essentially fees, 1 point equals 1% of loan amount), and other costs that are amortized over a shorter period, and various fees and other "sweeteners" (such as equity participation by the lender in some loans). The lender also may require cross-collateralization and a lower loan-to-value ratio. On the other hand, they are typically arranged quickly with relatively little documentation.

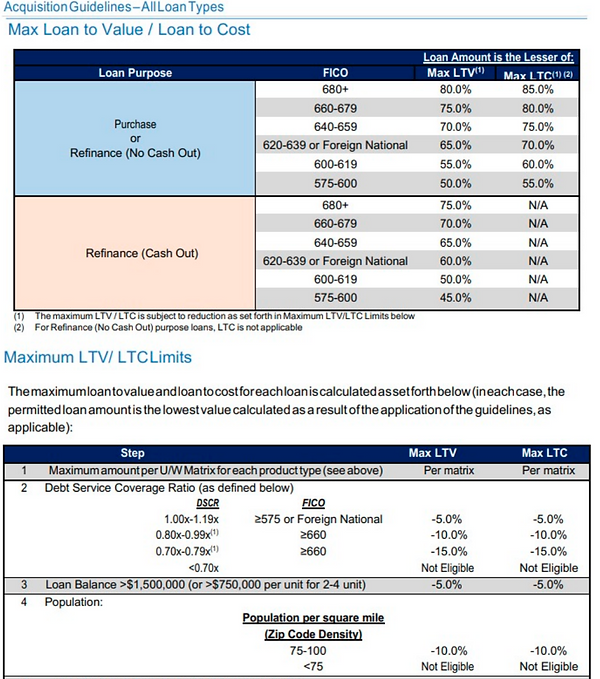

DSCR Loans

The debt service coverage ratio (DSCR), also known as "debt coverage ratio" (DCR), is the ratio of operating income available to debt servicing for interest, principal and lease payments. It is a popular benchmark used in the measurement of an entity's (person or corporation) ability to produce enough cash to cover its debt (including lease) payments. The higher this ratio is, the easier it is to obtain a loan. The phrase is also used in commercial banking and may be expressed as a minimum ratio that is acceptable to a lender; it may be a loan condition. Breaching a DSCR covenant can, in some circumstances, be an act of default.

No Doc Loan

A No-Doc or Low-doc loan (abbr: No/Low Documentation Loan) refers to loans that do not require borrowers to provide documentation of their income to lenders or do not require much documentation. It is a financial product commonly offered by a mortgage lender to consumers who cannot qualify for normal loan products because of fluctuating or hard-to-verify incomes, such as the self-employed, or to serve long time customers with strong credit.[1] Applicants are often required to provide a substantial down payment, i.e. a larger deposit either through equity in security or personal savings.

Self-employed, unemployed, seasonal workers, and new immigrants generally struggle to meet strict requirements to qualify for loans. A loan with few to no documentation or credit history requirements is easier to qualify for, but generally carries a significantly higher interest rate.

Bank lender Financing

80/20 Loan. Like traditional bank financing. Credit report is pulled. You have to meet certain lender requirements. Terms length

can be 5years, 7 years, 10 years, 15 years, 20 years or 30 years(most right now will not do the 30 years). Fixed Rate Interest or Adjustable rate interest.

\

-

Asset-based loan — a similar type of commercial loan based on real estate, indicating the loan will be based upon a percentage of the property's appraised value, as the key criteria

-

Private money — refers to lending money to a company or individual by a private individual or organization

-

Bridge loan — a similar type of commercial loan based on real estate

-

Non-conforming loan — a loan that fails to meet bank criteria for funding

Property Types

Multifamily like a 4 plex to 10 units, etc. Single Family, Apartment Buildings, Office Buildings, Medical Building. Hotels, Motels, Malls, Strip Plaza, Store Units, Gas Stations, Construction land development, New home building, industrial like warehouse, Mixed Use Property, Land purchase, Special purpose properties include amusement parks, bowling alleys, parking lots, stadiums, theaters, zoos, and much, much more. Property Portfolio Buy, Mortgage note buy, Tape deal buys.

The Right Way to Finance or Refinance Your Next Commercial Property

Rather than pull your hair out wondering how you’re going to afford the space to house your business, come to Westport Commercial and let us take care of everything. We specialize in commercial real estate financing, and best of all is the fact that we’re familiar with both large and small transactions. See what it’s like to not have to settle for your next commercial property.

Options for Every Scenario

Over the years we’ve been in business, we’ve learned how to put together commercial real estate packages for large and small transactions with both recourse and non-recourse options. Examples of some of the business real estate lending options we offer include:

-

FHA and HUD financing for brand new properties, remodeling and acquisitions, specifically for hospitals, senior housing and multifamily rental homes.

-

Conventional loans, if you need basic commercial property lending for an owner-occupied or investment property.

-

Mezzanine and equity financing for those who need financing that’s well-tailored to their specific needs.

-

Commercial Mortgage Backed Securities, also known as CMBSs, which is when gathered business properties are shifted into a trust before you have the option of selling them to investors in the form of bonds.

-

Constructing lending, if you’d rather build your business property from scratch. Loan limits range from $10,000,000 to as much as $100,000,000.

Bridge Loans

You might be looking for a new commercial property because you’re in the midsts of selling your current one. If so, you may require a bridge loan either in addition to commercial real estate financing or instead of commercial real estate lending. Either way, you’ll have the funds you need to buy your new property while waiting to sell your old one, providing you with a stable bridge over uncertain financial waters.

Westport Commercial representatives are here to provide you with any assistance you might need. Be sure to let us know if you’d like more info about business real estate financing.

Turn to Our Stated Income Commercial Real Estate Loan Programs

At Westport Commercial, we understand that your business may need money for a variety of purposes such as debt consolidation, refinancing, working capital, property purchases and property improvements. One way to get that money is through a stated commercial real estate loan.

Types of Property That You Can Finance

With the loans, you finance a piece of real estate that you own. For instance, if you own an apartment building or a warehouse, you can get a certain percentage of its worth. Other property types covered include restaurants and real estate (both retail and office).

Here’s a more-detailed look at property types and how much you can expect to get for each.

-

If you own an auto service place, a self-storage business, a warehouse or office space, you can expect a loan-to-value ratio (LTV) of up to 65 percent.

-

If you have an investment property with up to four units not occupied by you, your LTV may be up to 70 percent.

-

If you own multifamily or mixed-use properties of five units or more, your LTV could be as high as 75 percent. However, for that 75 percent, you need a credit score of at least 700 and need to meet a few other qualifications.

What You Need to Qualify

When you apply for stated income commercial real estate loans, you must show a few documents. For example, you must submit a W-2 or self-employed income financials. You should also have a credit score of at least 600.

Why Stated Income Commercial Real Estate Loans?

With our stated income commercial real estate loans, you could close on a loan up to $500,000 in as little as two weeks. No matter the type of commercial property you own, odds are good we will accept it. Loan terms are for up to 25 years, and the loans are fully amortized.

Talk with us today about getting a loan!

What Are Your Options?

When it comes to real estate financing for commercial properties, we offer a variety of options. They include:

-

Bridge Loans – Our bridge and hard money loans come with high LTVs, low variable rates and can reach up to $100,000,000. With interest-only amortization, you’ll quickly acquire the working capital you need.

-

Church Financing – Whether you need to expand your facilities, refinance debt, acquire land or finance a new construction project, we can customize a solution that’s just right for your religious organization.

-

CMBS – A commercial mortgage backed security is designed with you in mind. By taking commercial properties and securitizing them into a pool, we are able to keep them in trusts and sell them to investors. This allows us to offer low rates and fixed terms.

-

Construction Loans – Our construction loans are often restructured for permanent financing. Amounts begin at $10,000,000 and can reach $100,000,000 or more.

-

Conventional Programs – Our conventional programs are for mobile home parks, multifamily units, self-storage facilities and other similar properties.

-

Equity and Mezzanine Financing – By tailoring solutions to your specific needs, we pull from capital sources that include high net worth investors to bring you the funds you need most.

-

FHA and HUD Loans – With funds that reach $50,000,000, our FHA and HUD loans are made for multifamily units, hospitals and healthcare properties. This includes acquisition, new construction or rehabilitation of the property.

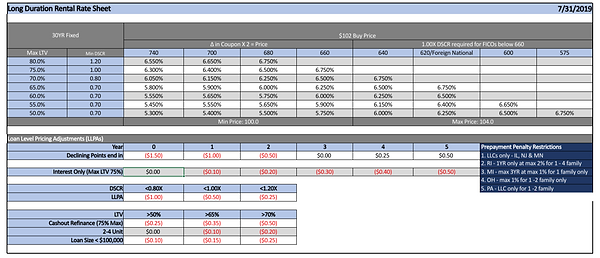

One of our lenders terms

30 Year Fixed Rate

1-4 Unit Properties (includes condo and townhomes)

6.5%-7% Fixed Rate (fully amortizing)

70% LTV Cash Out

70-75% LTV for Purchases or R/T refi

680 minimum Credit Score

55k Min Loan amount, 100k min property value

3,2,1 prepayment penalty

3 Week Close

9 Months Verified Reserves (cash out qualifies)

12 Month Lease with at least 6 months remaining

Another lender we work with.........

Purchase or Refinance & Rehab | Fix & Flip Program | Residential 1-4 units or Condominiums Loan amounts $75k -$3mm LTV Rehab LTC Experience Rate Minimum FICO 650 80-85% 100% 15+ 8.99% 12 Month Term, Interest Only Payments 80-85% 100% 3-15 9.99% No tax returns required 75% 100% 1-2 10.99% No Interest charged on rehab portion until funds are drawn 75% 100% 0 11.99% Points vary by loan amount, contact us for a quote. 85%/100% LTC available for experience of 3+ (as is value must be greater than purchase price). Experience level incudes investment property and/or flips w/in 3yrs. Refinance & rehab available max LTC of 60/100/55% with experience or 65%/100%/60% for new investors. Show 3 months Interest reserves + 20% of the rehab budget, no deposit. -5% for sub 680 FICO. Min Property value $50k.

Long Term 30 Year Rental Property Purchase or Refinance | Residential 1-4 units or Condominiums Loan Amount $55K - $3MM FICO LTV Rate* Points Purchase or Refinance Loans to 75% LTV 720+ 75% / 70% 6.25%- 7% 3% + 30 Year Fixed Mortgage 680-719 70% / 65% 6.5% - 7.5% 3.5% + 3yr Pre-pay (3%, 2%, 1%) Foreign Natl 70% / 60% 6.5% - 7.5% 3.5% + Portfolio Loans available, min property value $100k *Rates will vary based on loan amount, FICO, LTV and DSCR. Points vary by loan amount, contact us for a quote. 6 months on title to use current appraised value for cash out refinance. 9 months PITI reserves required. No Tax returns required. All refinances must be leased, no vacation rentals.

24 Month Bridge Loans for Purchase or Refinance | Residential 1-4 units or Condominiums LTV FICO Experience Rate Loan amounts $75k -$3mm 75% Purchase 650-680 11.49% Minimum FICO 650 65% Rate/Term 680-700 10.49% 24 Month Term, Interest Only Payments, 1 year Extension 60% Cash Out 700-740 9.99% No tax returns required 740+ 9.49% Pre-pay Penalty 5% First 6 Months; No Penalty Thereafter Points vary by loan amount, contact us for a quote. Max 1 Vacant Unit on 2-4 Unit Properties; Vacant SFR Only on Purchase Program Requires Minimum 1.15 DSCR (Annual Gross Rent / Annual Interest, Taxes, Insurance & Association Dues).

Commercial Bridge Loans for Purchase & Rehab Apartments 5+ and Mixed Use LTV Rehab LTC Experience Rate Loan amounts from $250k to $5mm 65% 100% 0 11.99% Apartments 5+ units, Mixed Use with > 50% Residential 65% 100% 1-2 10.99% Minimum FICO 650 70% 100% 3-15 9.99% No tax returns required 70% 100% 15+ 8.99% No Interest charged on rehab portion until funds are drawn Points vary by loan amount, contact us for a quote. 12 Month loan, interest only payments, extensions and payment reserve available. Experience level incudes investment property and/or flips. Refinance & rehab available max LTC of 60/100/55% or 55/100/50% cash out. Requires minimum in-place occupancy of 80% with lease verifications. Condo exit loans are sized based on as stabilized market rental value.

Another Lender That we work with as example

Another Lender we work with.

Need an investment loan? A Flip Loan? A Landlord Loan? Transactional Funding?

We loan Up To 70% of ARV

No Application, No Credit Check, No Appraisals, No Pre-Inspection No Prepay Penalty

No Survey No Upfront Fees

Loan Options: • 10% – 3 points • 12.25% – 2 points •